Corinth auto title loans offer swift access to cash with same-day approval, a convenient alternative to traditional banking. With transparent practices and clear communication, these loans provide robust protections and flexible terms. The personalized approach enhances customer experience, empowering individuals for informed decision-making and potential uses like debt consolidation.

Corinth auto title loans have become a popular financing option for many, offering quick access to cash. However, navigating this process can be daunting. This article breaks down the intricacies of Corinth auto title loans, equipping borrowers with knowledge about their rights and protections. We explore the step-by-step process, highlighting key considerations. Furthermore, we emphasize the importance of open communication in enhancing the overall service experience, ensuring a transparent and satisfactory loan journey.

- Understanding Corinth Auto Title Loans Process

- Customer Rights and Protections Explained

- Enhancing Service Experience Through Communication

Understanding Corinth Auto Title Loans Process

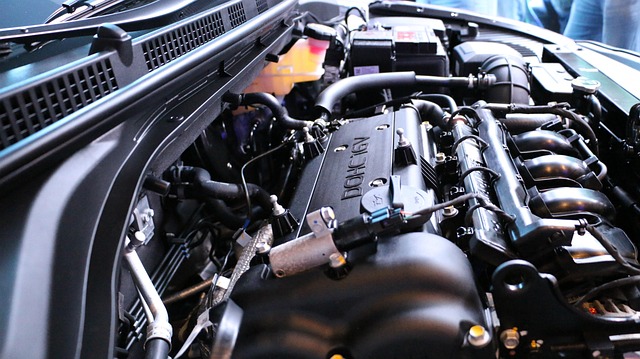

When it comes to Corinth auto title loans, understanding the process is key for any customer looking to secure funding quickly. This type of loan is a convenient option for individuals who own their vehicles and need access to cash fast. The process starts with the borrower submitting an application, providing details about their vehicle, including its make, model, year, and overall condition. This information is crucial in determining the loan amount offered. Once the application is approved, the lender will verify the vehicle’s title, ensuring it has no outstanding liens or encumbrances.

After a successful verification process, which can often be completed within minutes, borrowers can expect same-day funding for their Corinth auto title loans. This speed and efficiency are among the many advantages of this type of loan. Unlike traditional bank loans, which may require extensive paperwork and a lengthy approval process, auto title loans offer a streamlined approach to accessing capital. Additionally, options like boat title loans or title pawn can also be explored, providing borrowers with flexible alternatives to meet their financial needs promptly.

Customer Rights and Protections Explained

When it comes to Corinth auto title loans, customers have certain rights and protections that are designed to safeguard their interests. One of the key aspects is transparency throughout the entire loan process. Lenders are required to clearly communicate all terms, conditions, and fees associated with the loan, ensuring borrowers fully understand what they’re agreeing to. This includes explaining the interest rates, repayment schedules, and any potential penalties for early repayment or default.

Moreover, borrowers have the right to secure emergency funds using their vehicle’s equity without compromising their daily needs. With same-day funding, many Corinth auto title loan customers can gain access to the money they need promptly, providing a safety net during unexpected financial emergencies. It’s crucial for lenders to honor these rights and offer flexible loan terms tailored to individual circumstances, fostering a fair and supportive lending environment.

Enhancing Service Experience Through Communication

At Corinth Auto Title Loans, we understand that excellent customer service is built on clear and consistent communication. When it comes to secured loans like ours in San Antonio, keeping our clients informed every step of the way enhances their overall experience. We believe that transparency breeds trust, so we make sure to answer all your questions about the process, fees, and potential uses for these loans, such as debt consolidation.

Our dedicated team is committed to providing a stress-free environment, ensuring you feel supported and empowered throughout. Whether it’s explaining complex terms in simple language or offering guidance on managing loan repayments, we strive to create a seamless experience tailored to your unique needs.

Corinth auto title loans can be a convenient financial solution, but understanding customer service expectations is key. By familiarizing themselves with the loan process, their rights, and the power of open communication, borrowers can ensure a positive experience. Enhancing transparency and access to information creates a more satisfying journey for those seeking Corinth auto title loans, fostering trust in this alternative financing method.